On October 30, 2024, a remarkable story emerged from the Indian stock market. A small investment in Elcid Investments could have turned into a fortune for early investors. Reports indicate that an investment of just ₹1 lakh in Elcid Investments stock would have yielded an astonishing ₹670 crore within a few months. This incredible return has left many investors and market analysts in disbelief.

The Rise of Elcid Investments

Elcid Investments Ltd has become a hot topic in the financial world due to its meteoric rise in stock price. Just a few months ago, the stock was trading at around ₹3.21. However, recent trading sessions have seen its price soar to approximately ₹2,36,250 per share. This represents an unbelievable increase of about 66,92,535% over a short period.

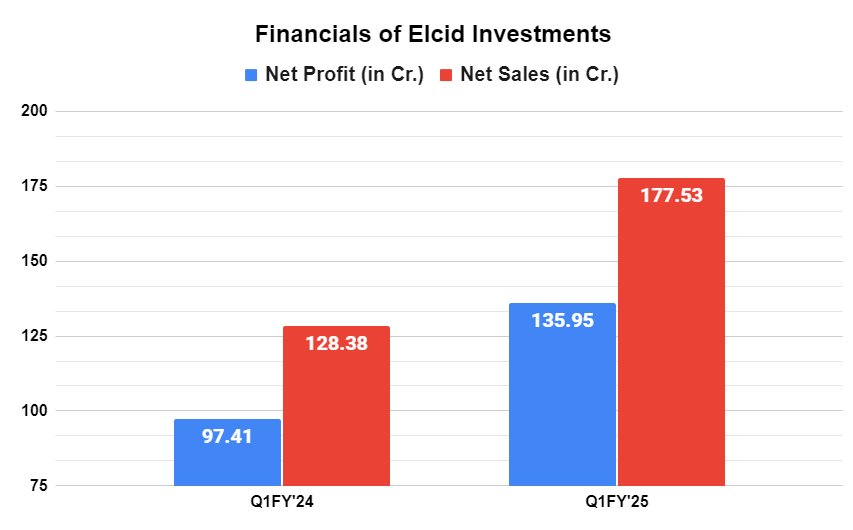

The surge in Elcid’s stock price is attributed to various factors, including its strong financial performance and strategic investments. The company is primarily involved in non-banking financial services and has been recognized for its robust growth over the years.

How Did This Happen?

Investors who bought shares of Elcid Investments at the beginning of this year are now reaping massive rewards. The company’s financial reports indicate that it has delivered significant profit growth, with a compound annual growth rate (CAGR) of 26.3% over the last five years. This impressive performance has attracted attention from both retail and institutional investors.

Additionally, Elcid Investments holds valuable assets, including a stake in Asian Paints, which further enhances its market value. As the company continues to post strong quarterly results, investor confidence has surged, driving up demand for its shares.

A Closer Look at the Numbers

To understand the scale of this investment opportunity, let’s break down the numbers:

- Initial Investment: ₹1 lakh

- Current Value of Investment: ₹670 crore

- Percentage Increase: Approximately 66,92,535%

This means that if someone invested ₹1 lakh in Elcid Investments just a few months ago, they would now have a staggering ₹670 crore. Such returns are rare and often considered “too good to be true” in the world of investing.

Market Reactions

The news of Elcid Investments’ skyrocketing stock price has created a buzz across social media and investment forums. Many investors are sharing their experiences and expressing disbelief at such extraordinary returns. Some are questioning whether this rapid increase is sustainable or if it represents a speculative bubble.

Market analysts suggest that while the returns are impressive, potential investors should exercise caution. The volatility associated with such rapid price increases can lead to significant risks if the stock price corrects itself.

Expert Opinions

Financial experts have weighed in on this phenomenon. Hitesh Dharawat from Dharawat Securities emphasized that while Elcid’s performance is commendable, investors should conduct thorough research before jumping into investments based solely on past performance.

He noted that understanding the underlying fundamentals of the company is crucial for making informed investment decisions. “While it’s tempting to chase high returns, it’s important to consider the long-term outlook and stability of the company,” he said.

Conclusion

The story of Elcid Investments serves as a reminder of how quickly fortunes can change in the stock market. An initial investment of ₹1 lakh turning into ₹670 crore in just a few months is an extraordinary example of market potential and risk.

As always, potential investors should approach such opportunities with caution and do their due diligence before making any investment decisions. While Elcid Investments has proven to be a lucrative opportunity for some, the volatility and unpredictability of stocks mean that what goes up can also come down.

The future remains uncertain for Elcid Investments as it navigates this new landscape as one of India’s most talked-about stocks. Investors will be watching closely to see how this story unfolds in the coming months.

Citations:

[1] https://www.screener.in/company/503681/consolidated/

[2] https://www.moneycontrol.com/india/stockpricequote/finance-investments/elcidinvestments/EIL

[3] https://groww.in/stocks/elcid-investments-ltd

[4] https://www.youtube.com/watch?v=aXhRdzbTQCY

[5] https://vakilsearch.com/consumer-complaints/travel/make-my-trip/6418918eb62bc2b9798b29e1

[6] https://economictimes.indiatimes.com/industry/renewables/ola-electric-forms-new-service-team-amid-rising-customer-complaints/articleshow/113455267.cms

[7] https://www.youtube.com/watch?v=ffdaCUdWRNQ

[8] https://www.reddit.com/r/hardware/comments/1gex74n/apple_launches_mac_mini_with_m4_and_m4_pro/

[9] https://www.hindustantimes.com/business/indias-costliest-stock-went-from-rs-3-to-rs-2-36-250-heres-how-101730256793806.html

keywords:

Elcid Investments, stock market, investment returns, ₹1 lakh investment, ₹670 crore profit, October 2024, most expensive stock India, stock price surge, financial news, investment opportunities, smallcap stocks, market volatility, Asian Paints stake, retail investors, stock trading, price discovery auction, financial growth, investor confidence

BBR is largest active consumer community. Amplifying consumer voice since 2018.

1 thought on “Elcid Investments: The Stock That Turned ₹1 Lakh into ₹670 Crore in Just Months”

Comments are closed.